Australia’s hotel and accommodation market continues to evolve, driven by changing traveller expectations, improved booking technology, and increasing demand for flexible short-stay accommodation. For serviced apartment operators and professionally managed accommodation providers, understanding how guests are booking in 2025 is critical to maintaining occupancy, controlling costs, and attracting the right mix of corporate and leisure stays.

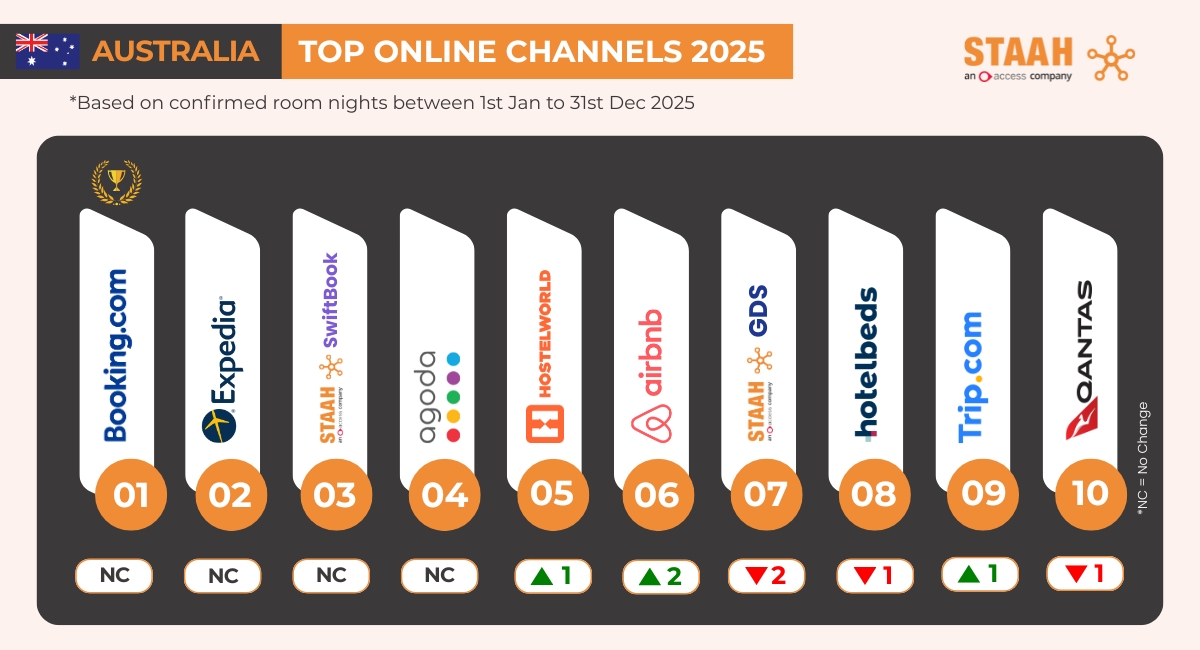

Recent industry data released by hospitality technology provider STAAH offers valuable insight into how travellers are booking hotels and accommodations across Australia. The findings confirm a clear shift toward diversified booking strategies, with major online travel agents (OTAs), direct bookings, and corporate channels all playing an important role in the modern accommodation landscape .

For serviced apartment providers like Corporate Keys, these insights reinforce the importance of balancing visibility with profitability while catering to the specific needs of business travellers and extended-stay guests.

Australia’s Hotel and Accommodation Market in 2025

Australia remains one of the most mature and digitally advanced accommodation markets globally. Travellers — particularly corporate guests — are highly comfortable booking online, comparing rates, and selecting accommodation based on flexibility, location, and value rather than brand alone.

In 2025, demand across Australia has been driven by:

This environment has accelerated demand for serviced apartments and short stay accommodation, where guests benefit from space, privacy, and cost efficiency compared to traditional hotels.

Booking.com Still Dominates Hotel and Short Stay Accommodation Bookings

According to STAAH’s Australian booking data, Booking.com continues to lead as the largest source of completed accommodation bookings across the country.

Its success in Australia is underpinned by:

For short stay accommodation providers, Booking.com remains an effective channel for exposure, particularly for first-time guests, relocation stays, and inbound travellers unfamiliar with local accommodation brands.

However, high commission costs mean Booking.com works best as part of a broader distribution strategy rather than as a sole source of bookings.

Direct Bookings Are Growing for Serviced Apartments

One of the most important trends highlighted in the 2025 data is the continued growth of direct bookings across Australia.

Hotels and serviced apartment operators are increasingly investing in their own booking platforms to:

For serviced apartments and short stay accommodation providers, direct bookings are particularly valuable. Corporate guests, project teams, medical travellers, and relocating families are far more likely to book directly once trust is established, especially for stays beyond a few nights.

This trend aligns strongly with Corporate Keys’ business model, where repeat corporate bookings and longer stays form a significant portion of demand.

Expedia, Agoda and Channel Diversification in Australia

While Booking.com holds the top position, other OTAs continue to play an important role in Australia’s accommodation market.

Expedia remains a strong performer across both corporate and leisure segments, particularly for business travellers booking accommodation alongside flights and transport .

Agoda also maintains a notable presence, appealing to price-conscious travellers and international guests booking short stay accommodation in Australian capital cities.

For serviced apartment operators, this highlights a key takeaway:

Different booking channels attract different traveller types. A diversified channel mix ensures consistent occupancy across weekdays, weekends, and seasonal fluctuations.

Airbnb and the Shift Toward Apartment-Style Accommodation

The continued strength of Airbnb in Australia reflects a broader change in traveller preferences. Guests increasingly prioritise:

This trend has blurred the traditional line between hotels and alternative accommodation.

Professionally managed serviced apartments are uniquely positioned to benefit, offering the flexibility guests want without the operational risks associated with informal short-term rentals. For corporate travellers in particular, reliability, compliance, and service standards remain critical — areas where professional accommodation providers outperform peer-to-peer platforms.

Corporate and Wholesale Booking Channels Remain Essential

Beyond leisure travel, STAAH’s data confirms the continued importance of:

These channels are particularly relevant for:

For Corporate serviced apartments in Australia’s CBDs and business hubs, maintaining strong corporate distribution is essential to securing stable, repeat demand throughout the year.

What This Means for Serviced Apartments and Short Stay Accommodation Providers

The 2025 booking trends point to several strategic priorities for serviced apartment operators in Australia:

1. Maintain Strong OTA Visibility

OTAs remain critical for reach and discovery, especially for new guests and inbound travellers.

2. Prioritise Direct Booking Capability

A professional website with real-time availability and corporate-friendly booking options is essential, for example, direct booking with Corporate Keys ensures the best available rates, flexible corporate terms, faster confirmations, and personalised support without third-party booking fees.

3. Focus on Corporate and Extended-Stay Demand

Business travellers value consistency, flexibility, and value — all strengths of serviced apartments.

4. Balance Volume with Margin

Successful accommodation providers use OTAs for exposure while steadily converting guests to direct relationships.

The Future of Hotel and Short Stay Accommodation in Australia

Australia’s accommodation market is highly competitive, and the most successful operators are those who adapt quickly to changing booking behaviour.

As highlighted in the STAAH report, a diversified distribution strategy — combining OTAs, direct bookings, and corporate channels — is now essential for hotels and serviced apartment providers seeking sustainable growth .

For Corporate Keys and similar providers, this approach supports higher occupancy, better cost control, and stronger long-term relationships with corporate clients.